Loans may be tricky as we need to know all the specific details of the possible loan like interest, installment, and monthly mortgage, especially when it comes to housing. I like to know everything first before jumping in to get a loan.

It is also important to see the estimate of the total amount I need to pay to finish a loan and understand the terms and conditions. Fortunately, there is the Housing Loan Calculator app that guides me when deciding to get a housing loan.

Learn more about the Housing Loan Calculator app and its features below. Check how I use the app to compute the different fees related to a housing loan through the Housing Loan Calculator app.

- Discover the Housing Loan Calculator App

- Grant Permissions to the Housing Loan Calculator App

- Exploring the App’s Features

- Check a Property Valuation on the App

- Compute for Legal Fees on the App

- Assess One’s Debt Service Ratio on the App

Discover the Housing Loan Calculator App

I only have limited knowledge of the housing loan process, including the legal documents, loan rates, house valuation, etc. Luckily, I discovered the Housing Calculator app, which is tailored to the country's conditions, requirements, and processes.

The Housing Loan Calculator app is a property financing tool for Malaysians. I can easily calculate the housing loan, affordability, legal fees, and other related fees through the app when I decide to take a housing loan.

I have heard about the Housing Loan Calculator app from my friends, and they had great reviews as it helped them when they got housing loans. The app has excellent user reviews and ratings because of its beneficial and convenient features.

Users loved the Housing Loan Calculator app's yield calculator, debt service ration, compass, real property gains tax calculation, etc. True to its mission to help Malaysians with housing loans, the app provides all the necessary information that must be considered before taking a loan.

Get the Housing Loan Calculator App

HZ Mobile App launched the Housing Loan Calculator app to Malaysians in July 2015. The team made the app available on Android devices. Thus, the Housing Loan Calculator app is only available to download from the Google Play Store.

The app gained popularity among Malaysians looking for a tool to help us decide if taking a housing loan is worth it. At present, the Housing Loan Calculator app has recorded over 100,000 downloads.

The Housing Loan Calculator app is free to download, so it has no in-app purchase items available or premium subscriptions. The team only requires us to install the app on Android 8.0 and up devices.

Grant Permissions to the Housing Loan Calculator App

Even though the Housing Loan Calculator app is tailor-fit to Malaysian rates, the app is still available for almost all countries. It means that even if I am in the United States, I can check the housing loan rates in Malaysia that I may use for future reference.

Upon installing the Housing Loan app, the team mentioned that I automatically granted the app the following permissions to access and do things on various features and functions of my mobile device.

First, the app needs to access my current location, including the approximate location through network-based and precise location via GPS and network-based. Although, the app's availability will not be changed because of my current location because it can be used in almost all countries.

The Housing Loan Calculator app also asks permission to read, modify, and delete any content in my local file storage, including photos, videos, and other media files. The app also needs to view my Wi-Fi connection.

More About the Permissions

Aside from the location, file storage, and Wi-Fi connection information, the app also wants to change and do different functions of my mobile phone. The Housing Loan Calculator wants to view network connections and connect or disconnect from Wi-Fi.

The app also asks for full network access as I need an internet connection to use its features and services. The Housing Loan Calculator app also wants to run at startup and control vibration. Lastly, it seeks permission to prevent my mobile device from sleeping.

Exploring the App’s Features

When I installed the Housing Loan Calculator app, it welcomed me with its main features. The app did not require me to create an account or register to be able to enjoy its calculators and other features.

The app's Home page displays the calculator and the important information about a specific aspect of a housing loan. I can easily check out these pieces of information because the app is straightforward when it comes to its content.

All the app's other features can be seen in th menu found in the upper left corner of the screen. The Housing Loan Calculator app has the following feature: Loan Calculator, Valuation Checking, Affordable Loan Calculator, Legal Fees Calculation, Yield Calculator, Debt Service Ration, Real Property Gains Tax, and Compass.

This section also contains the Settings menu and the "Smart Home Cover".

Calculate Loans on the App

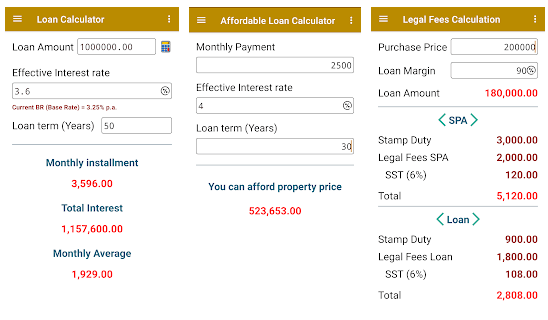

The primary feature of the Housing Loan Calculator app is the Loan Calculator. It is aligned with the current average loan rates in Malaysia. In this calculator, I can find the following: Loan Amount, Effective Interest Rate, Loan Terms, Monthly Installment, Total Interest, and Monthly Average.

The app asks me to fill in my current loan amount, effective interest rate, and loan term in years. The Housing Loan Calculator app can use the current base rate (3.25% p.a.) for the effective interest rate if there is no specific interest rate indicated in the loan.

After filling out the needed information, the app will automatically compute my monthly installment, total interest, and monthly average. Since these pieces of information are quite general, I can also use the loan calculator for other loans that I have, such as an auto loan.

Check a Property Valuation on the App

Another feature I often use in the Housing Loan Calculator app is "Valuation Checking." Here, I can find how much value a property has so that I will know if the current value rate given by a bank for a loan is accurate to its estimate.

In this feature, the app asks me to fill in the necessary information and details about the property so that it can do the estimate. The Housing Loan Calculator app wants to know the property type, location, area, and owner asking price.

I may also add the following details: size (SF), land area, number of units, floor level, car park/s, unit condition, and renovation cost. It is also necessary to indicate the unit attachment like kitchen cabinet, wardrobe, etc.

The app also wants to know the price when the property is being rented out per month. The computation of the property valuation checking may take a while. I may also ask the app to send me the valuation check via SMS or email.

Use the Affordable Loan Calculator

The Affordable Loan Calculator feature is almost the same as the Loan Calculator. However, the Affordable Loan Calculator provides the estimated property price when received through a loan.

In this feature, the app asks me to provide the rate provided by the owner or bank in terms of the monthly payment, effective interest rate, and loan terms (years). For example, the monthly payment is RM 3500 with an average effective interest rate of 3.5% per annum.

Then, I indicate that the loan term is for ten years. The app will inform me that I can afford the property at RM 353,943. It is good to estimate how much I need to pay in total or save.

Compute for Legal Fees on the App

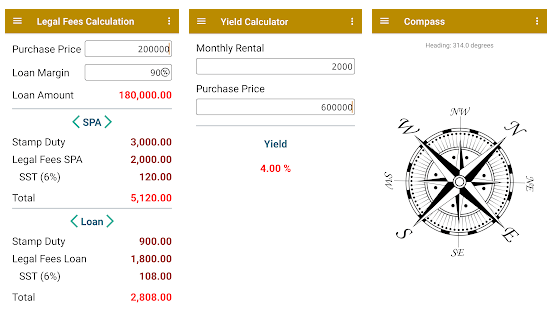

Legal fees are part of a housing loan application because I need to duly process legal documents to successfully get a loan. The Housing Loan Calculator app estimates how much legal fees I need to pay when I get a property.

The app asks me to provide the purchase price and loan margin (in terms of interest rate). Then, the app will compute the loan amount, wherein it will base the computation of the legal fees.

There are two fees that I need to pay: The Sale and Purchase Agreement (SPA) and Loan. The app lists the breakdown of the fees for these two: stamp duty and legal fees (SST 6%).

Utilize the Yield Calculator

Another interesting feature of the Housing Loan Calculator app is that I can compute the rental yield. This calculates the rent return (in value or money) a property earns before considering any property expenses. This tells me how much I could earn as a percentage of the property's market value annually.

Before taking a property, I need to see if it will yield a profit when I make it available for rent. Through the Yield Calculator feature, I can check how much yield I can get by providing the monthly rental and purchase price.

Assess One’s Debt Service Ratio on the App

I am also allowed to check my debt service ratio to assess how capable I am of taking a new housing loan. Thus, the app asked for my monthly basic salary or income. I also need to indicate my total fixed allowance or expenditure for an entire month.

The app also wants to know my total statutory deduction so I can check my total net income after the deductions. In addition, the Housing Loan Calculator app needs to see all my monthly credit commitments, including house loans, vehicle loans, personal loans, and credit card payments.

After providing all the information, the app can now calculate my debt service ratio to assess whether I can still apply for a new housing loan.

Know the Real Property Gains Tax

The last feature of the Housing Loan Calculator app is the Real Property Gains Tax. In this feature, the app asks me to indicate the purchase price, miscellaneous cost, purchase date, selling price, miscellaneous cost and enhancement cost, and selling date.

It also asks for the category, either individuals (citizen and permanent residents), individuals (non-citizens), or companies.

Conclusion

The Housing Loan Calculator app allows users to compute all necessary information about acquiring property through a loan. This finance app also offers different calculators and information, which the users can use when deciding to take a housing loan.

Last updated on December 28th, 2022 at 06:00 pm