Most errands nowadays are completed digitally or online because people value convenience above everything else. This is why Scotiabank introduced its mobile banking app, so customers can bank whenever and wherever they are.

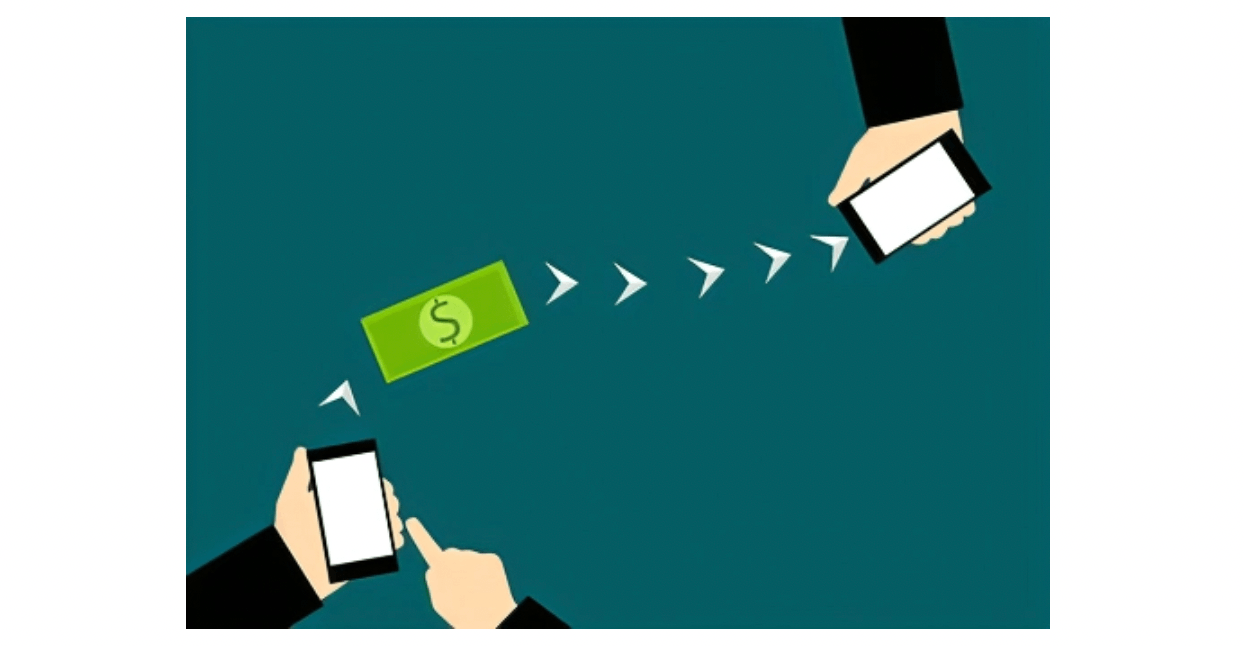

Paying bills, transferring funds, receiving eStatements, checking credit scores, depositing checks at home, and managing account information are all made simple with the Scotiabank Mobile Banking app.

In this guide, learn about the benefits of using the Scotiabank Mobile Banking app. Find out about the safeguards Scotiabank employs to keep its customers' data safe. Finally, learn how easy it was for me to apply for a Scotiabank card right from its mobile banking app.

- What Is Scotiabank?

- What Are the Log In Security Features of the Scotiabank App?

- How Do You Setup AutoPay on Scotiabank Mobile Banking App?

- How Do You Transfer Money Abroad through the Scotiabank App?

- Does Scotiabank Mobile Banking App Display the Credit Score?

- How Do You Request a New Card via the Scotiabank App?

What Is Scotiabank?

Officially known as The Bank of Nova Scotia or La Banque de Nouvelle-Écosse, Scotiabank is a Canadian financial institution. The Canadian city of Toronto is home to the global headquarters of this banking conglomerate.

Scotiabank is considered one of Canada's "Big Five" financial institutions. Regarding market capitalization and deposits, Scotiabank is the third largest Canadian bank. As a global business, it serves approximately 25 million clients and customers.

The Scotiabank brand is currently prevalent in over 20 countries. Australia, the Bahamas, Brazil, Canada, China, Costa Rica, Hong Kong, India, Japan, Malaysia, Mexico, Singapore, the United States of America, and the United Kingdom are just some countries where this bank operates.

Where Can You Get the Scotiabank Mobile Banking App?

Scotiabank wanted to meet its customers' needs at any time and place. The bank made a mobile banking app so customers could use the bank's services even if they were waiting in line, just woke up, or were busy at home.

With this in mind, the Scotiabank Mobile Banking app provides great convenience for Scotiabank customers. The bank ensured its banking services were available in the Scotiabank Mobile Banking app.

Customers of Scotiabank can do their banking when, where, and how they want, no matter what they are doing. People can get the Scotiabank Mobile Banking app free from the Google Play Store or the Apple App Store.

What Are the Log In Security Features of the Scotiabank App?

When I downloaded the Scotiabank Mobile Banking app, it asked for my bank account number and other personal information to verify if I have a Scotiabank account. The app also wanted me to enter user account information, including a password for my Scotiabank Mobile Banking account.

It is a common problem that other people might be able to get into your account and make unauthorized transactions, so Scotiabank ensures that its mobile banking app users are safe through biometric authentication.

I can use my fingerprint or Face ID to log into my Scotiabank Mobile Banking app account. To set up, I clicked "More" on the app's home screen to set up biometric authentication. Then, I tapped "Privacy and security" and clicked "Manage Touch ID."

How Do You Pay Bills Online via the Scotiabank Mobile Banking App?

Scotiabank Mobile Banking can make bill payments. This means I can save time by not waiting in long lines to pay my monthly bills.

Once the transaction is done, I will get a reference number and a receipt as proof of payment, just like when I make the payment in person at Scotiabank branches. However, bill payments through the mobile banking app can take up to three days to process.

Thus, Scotiabank reminds its customers to pay their bills online days before the due date so that the billing company has time to process the payment before the actual due date. Scotiabank Mobile Banking app also keeps a record of all the transactions so that users can always get information about their payments.

How Do You Setup AutoPay on Scotiabank Mobile Banking App?

Another thing I find convenient about the Scotiabank app is the AutoPay feature. This means I do not have to provide my billing account information whenever I want to pay.

The bank asks users if they want to set up the AutoPay feature through the app. This feature includes credit cards, mortgage payments, and utility bills. With AutoPay, I can set up a way to pay my mortgage ahead of time, so I do not miss a deadline and avoid late penalties.

To do this, I must set up or select the mortgage account in the Scotiabank Mobile Banking app. Then, I must click "Additional Services" to see what payment options are available.

Generally, Scotiabank makes it easy for us customers to manage, pay, pre-pay, and re-pay our Scotiabank mortgage accounts. On the app, I can also see how much prepayment is left.

Are Money Transfers Available on the Scotiabank Mobile Banking App?

Scotiabank Mobile Banking makes sending money to other people easily, so I can split a bill or pay someone back with just a few taps. Interac e-Transfer is a service Scotiabank offers that makes it easy and quick to send, request, and receive money from friends, family, and coworkers.

This services is reserved for Canadian account holders only, which means I can only send and receive money online from people with a Canadian bank account. To use this service, customers must first add the person they want to send or receive money from as a contact for Interac e-Transfer.

Interac e-Transfer has a daily limit on the number of transactions that can be made, which differs for each customer. From the Accounts page, tap "Manage My Account" to see how much you can transfer. Choose "Manage ScotiaCard & Account Access" from the Profile. Finally, click "Fastcash account setting" to see the limit.

How Do You Transfer Money Abroad Through the Scotiabank App?

Scotiabank also makes sending money outside Canada or abroad easy and safe. Through the Scotia International Money Transfer, I can send money anywhere in the world through the Scotiabank Mobile Banking app.

Compared to other money transfer services, it has a low fee. I love that Scotiabank wants us to pay as little as possible in fees so that the people who receive the money can get a bigger amount. With this service, I can also avoid having to pay extra fees.

I only need to add the recipient as a contact on the app, just like with the Interact e-Transfer. After adding the person as a contact, I can immediately send money to them anytime. However, this service limits how much I can transfer, which varies from account to account.

Does Scotiabank Offer eStatements?

Scotiabank Mobile Banking also keeps track of all the accounts that have been processed, paid, or received through the app. Scotiabank urges its customers to switch to paperless eStatements.

I can choose to get all my statements electronically through the app, which is faster and easier to use. The information that the app collects will also be kept safe, so there will not be any information leaks.

I can still print and download eStatements from the last 24 months. The app stores the statements for seven years.

Does Scotiabank Mobile Banking App Display the Credit Score?

Along with eStatements, I can avoid having to get printed copies of my credit score because I can see it right on the Scotiabank Mobile Banking app.

Through TransUnion Credit Score, I can track how my credit score has changed each month and look at my credit report. I only need to tap the TransUnion Credit Score button on the app at any time to see the credit score.

The bank recommends that I sign up for TransUnion Credit Score before I can read and agree to the Terms and Conditions of the service. There are also some suggestions for how to raise my credit score on the Scotiabank Mobile Banking app.

How Do You Deposit Cheques at Home via the Scotiabank App?

Scotiabank Mobile Banking supports depositing cheques from home to make things even easier. It means I can deposit cheques without going to the branch and doing it by hand.

I must use Scotiabank Mobile Banking to take a picture of the cheque. On the home screen, I must click "Transfers" and look for "Deposit a cheque." Then, I need to choose the account at Scotiabank where I want to deposit the money and enter the amount.

The next step is to take a picture the cheque's front side and back side. Once done, Scotiabank will inform me that the transaction or deposit was successful.

How Do You Request a New Card via the Scotiabank App?

To provide further convenience, Scotiabank supports applying or requesting a new card via the Scotiabank Mobile Banking app. I only need to sign in to online banking or mobile banking account.

Then, I need to check the Accounts page to select the “Manage My Accounts” option. After that, I must click the “Profile” button. Finally, there are two options for me: replace or change Scotiacard.

How Do You Manage Information on the Scotiabank App?

The Scotiabank Mobile Banking app is also an excellent way to manage and update my bank account information. The Scotiabank app makes it easy for me to check account balances and see what transactions have been made.

I can also change my address anytime, and the change will be made in the bank's records immediately. It is also possible to order cheques online, so I do not have to go to the branch to request them.

Conclusion

The Scotiabank Mobile Banking app allows users to safely and easily access bank services from their mobile devices. Customers have various online banking options, including bill pay, domestic and international money transfers, account management, and the ability to deposit cheques at home.

Last updated on December 26th, 2022 at 07:22 pm