There are a plethora of digital wallets that people use for transferring money and paying for online services/products. PayPal may be the most popular e-wallet worldwide, but Venmo is also a go-to option for millions of people (especially teenagers).

It integrates the idea of sending money while also acting as a social platform. This makes the transaction process much more fun.

Over the past couple of years, its parent company, PayPal, has made some serious effort towards making Venmo an even more reliable and versatile service. Let’s take a look at what it has on offer.

The History of Venmo

Founded back in 2009, Venmo was quickly bought by Braintree, which was acquired by PayPal in 2013. Since then, it has stood up to par with the reliability of service that its parent company is able to offer. Although it was mostly used by millennials at first, people of any age now use Venmo to perform P2P transactions.

It is well known that PayPal strongly encourages companies and other businesses to use their service. This is the main difference between it and the digital wallet that we are reviewing, as Venmo is restricted to personal use.

Are There Any Restrictions?

Venmo works as a service for making online payments and person-to-person transactions, as well as a social media feed. This is probably why there are certain daily and monthly transaction limits. This is something that you won’t find with PayPal.

The Venmo Concept

One of the coolest points of this digital wallet is that it stimulates communication between people who are parties to the transaction. For example, if you are paying back your friend for that drink last night, you have the opportunity to leave a funny message to which they can comment.

You can still hide transactions from your feed if you don’t feel like anyone else should see them. Obviously, the interpersonal concept is the main reason why you need to be careful when it comes to sending your money.

Tricky Refund

Unfortunately, if you accidentally send your money to the wrong person, Venmo won’t be able to do anything about it. Your best bet is to inform the recipient of the issue and kindly ask them to send you the money back.

The Versatility of Venmo as a Digital Wallet

Again, you can’t use this digital wallet for settling business transactions or paying for a service, such as a Netflix or Amazon Prime subscription. Still, a friend could pay the monthly streaming fee for these, and you could simply send the money via Venmo.

There is no fee for using this digital wallet, but there are a couple of e-banking related charges that you can encounter. For example, if you want to pay through your credit card connected with Venmo, then you will be charged 3% of the sum from your balance or debit card.

You Can Pay for Certain Services

Certain merchants and services, such as Uber and Lyft, have started doing business with Venmo. You can successfully connect your account and pay through Venmo instead of having to go through all the hassle of connecting your credit/debit cards.

Getting Started with Venmo Digital Wallet

Venmo is available for iOS, Android, and web users. This is one of the main reasons why it became so popular in such a short amount of time. Open the Apple or Google Play stores, find the app, and download it for free.

You will be immediately introduced to all the potential fees, and as we have already said, there isn’t a lot that you should worry about. You won’t be paying any monthly or annual maintenance fee, which is common with mobile banking and some payment apps.

Connecting Your Facebook Account

When it comes to creating your Venmo account, there are several different options. One of the most popular is connecting your Facebook account with Venmo. As for the other options, you can either type in your email address/full name along with a password or connect using your mobile number.

Verifying Account and Connecting Your Bank

After you have created your account, you will be sent an SMS code to verify and allow you to use this service for free. The next step should be to choose the payment method, whether that is connecting your debit card or providing the service with your bank account details.

Although credit cards can be used for Venmo transactions (don’t forget the 3% fee), you still need to connect it to your bank account. You can enter the online banking details or give Venmo permission to contact your bank and verify the authenticity of the provided info.

Verifying Your Identity

Connecting with your contacts/friends through Facebook and ensuring that your identity is verified goes a long way when it comes to raising your transaction limits. The initial weekly limit is set at $299.99, but when you successfully go through the transaction process, that limit will be raised to $6,999.99.

Sending Money to Your Friends/Family Members

While we were testing Venmo, we found that it has quite a specific approach in terms of syncing your contacts. You should either allow Venmo to access your mobile contacts or connect it with your Facebook account.

Another efficient option is sending them a referral link. If they don’t have or don’t want to create a Venmo account, then you can perform the transaction by having your friends scan the relevant QR code. This feature goes a long way if you don’t have this person in your contacts.

Restricting the Visibility of Transactions

If you simply don’t want other people to know about the transactions that you are performing, you can go to “Settings - Privacy and Sharing”, where you will find the Participants Only button. This will prevent others from seeing or sharing your previous activities.

Paying for Online Services/Products

As it is evolving, Venmo is following in the footsteps of its parent company, PayPal. Today, you can “Enable Mobile Web Purchases” and have the ability to settle transactions with your Venmo account.

When it comes to the stores that you can pay at, some of the most popular are Footlocker, Jane, and Lululemon, as well as hundreds of other well-recognized retailers. You can also pay for delivery services from Grubhub or rides from Uber or Lyft.

Advantages Over PayPal

Why bother setting up a Venmo account for a mobile app/online store payments when you can do it with PayPal? First, you can post the transaction on your social feed and let others know. Also, you can request to split the cost of the service with some of your contacts.

How Safe is Venmo?

Unfortunately, online breaching and hacking is a common occurrence. As Venmo is directly connected to your bank account/debit card, the encryption that it offers is excellent. It protects users from unnecessary data logging, and according to its ToS, it doesn’t share any info with third-party websites.

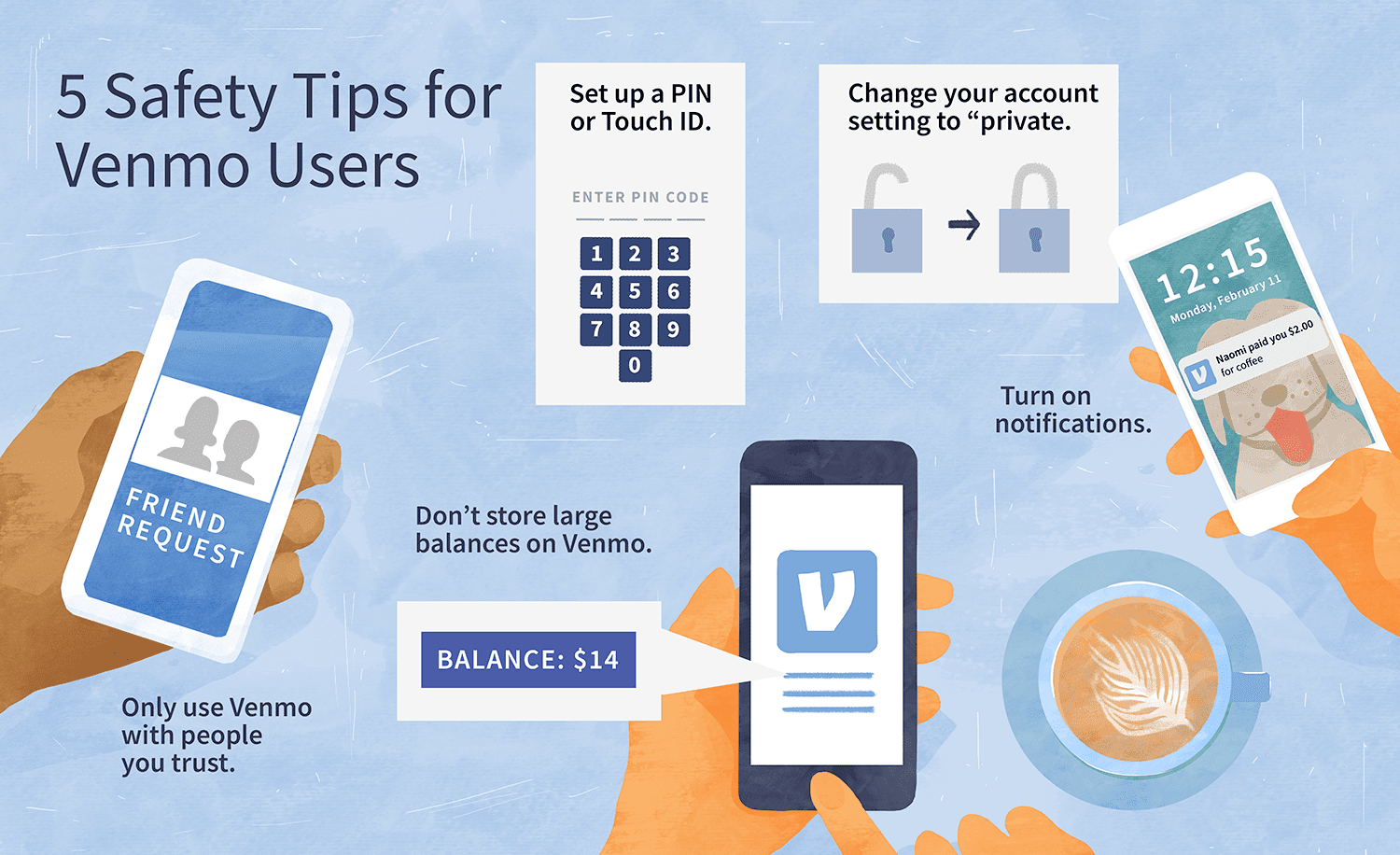

Additionally, there are a couple of things that you can do to prevent security risks. Set up a PIN code or Touch ID for logging into the account. Also, it is much better if you keep all of your transactions private, and don't store too much cash in your Venmo account.

The Importance of Contacts

Once again, Venmo isn’t made for exchanging money with unknown contacts. Thus, if that is something you are looking for, other digital wallets provide you with a much better refund and privacy policy.

What to Expect From Venmo

Venmo has been growing in popularity, so the company decided to issue a Venmo Mastercard that can be used at a network of ATMs worldwide. It is good for regular retail store payments, as well as any transactions that the Mastercard platform allows. There is also a set of cashback rewards (on certain purchases) that you can learn more about on Venmo's website.

One of the coolest points is that you can now set up direct deposit and get paid by your employer through a Venmo account. All you need is a routing number. Keep in mind that this can be used for government stimulus and tax refunds, as well.

Fun Emojis

At the end of the day, Venmo isn’t forgetting the social media part of their concept. Looking at the library of stickers and emojis, there are a variety of animations that you can post in the transaction description to simply have a lot of fun!

What Are the Main Venmo Risks?

By revealing your account info to unknown parties, you are putting yourself at risk of getting scammed. One of the most common methods is phishing, where you get a payment that you shouldn’t have and the third party/hacker use the transaction to steal your account/banking information.

As we have suggested multiple times, Venmo is trying to adjust its platform to work with businesses, but it simply isn’t naturally integrated yet. You are much better off staying away from these transactions than selling your product and not getting a payment that should have been made through Venmo.

Requested Payments

If someone acquires a list of your contacts, they may try to create an account with identical/similar credentials to trick people into sending them a payment. If you get such an email, call your contacts and verify whether they have made a payment without you knowing.

Summary

We think that Venmo has a bright future as a platform. The fact that millennials even created the phrase “to Venmo” is proof of how popular it is.

With that in mind, you should feel free to reap the advantages that this digital wallet offers - just don’t forget to be cautious and act according to Venmo's ToS!

Last updated on December 23rd, 2022 at 07:52 pm